The 5-Minute Rule for 10 2 10 3

Wiki Article

6 Simple Techniques For 10 2 10 3

Table of ContentsUnknown Facts About 10 2 10 3The Basic Principles Of 10 2 10 3 Not known Factual Statements About 10 2 10 3 All About 10 2 10 3Some Known Factual Statements About 10 2 10 3 10 2 10 3 for Beginners

Residence insurance coverage might likewise cover clinical expenditures for injuries that individuals received by being on your building (10 2 10 3). When something is harmed by a disaster that is covered under the residence insurance coverage plan, a property owner will certainly call their house insurance coverage business to submit a claim.Home owners will generally need to pay a deductible, a set amount of cash that comes out of the home owner's purse before the home insurance policy firm pays any kind of money in the direction of the insurance claim. A home insurance coverage deductible can be anywhere in between $100 to $2,000. Typically, the greater the insurance deductible, the lower the annual costs expense.

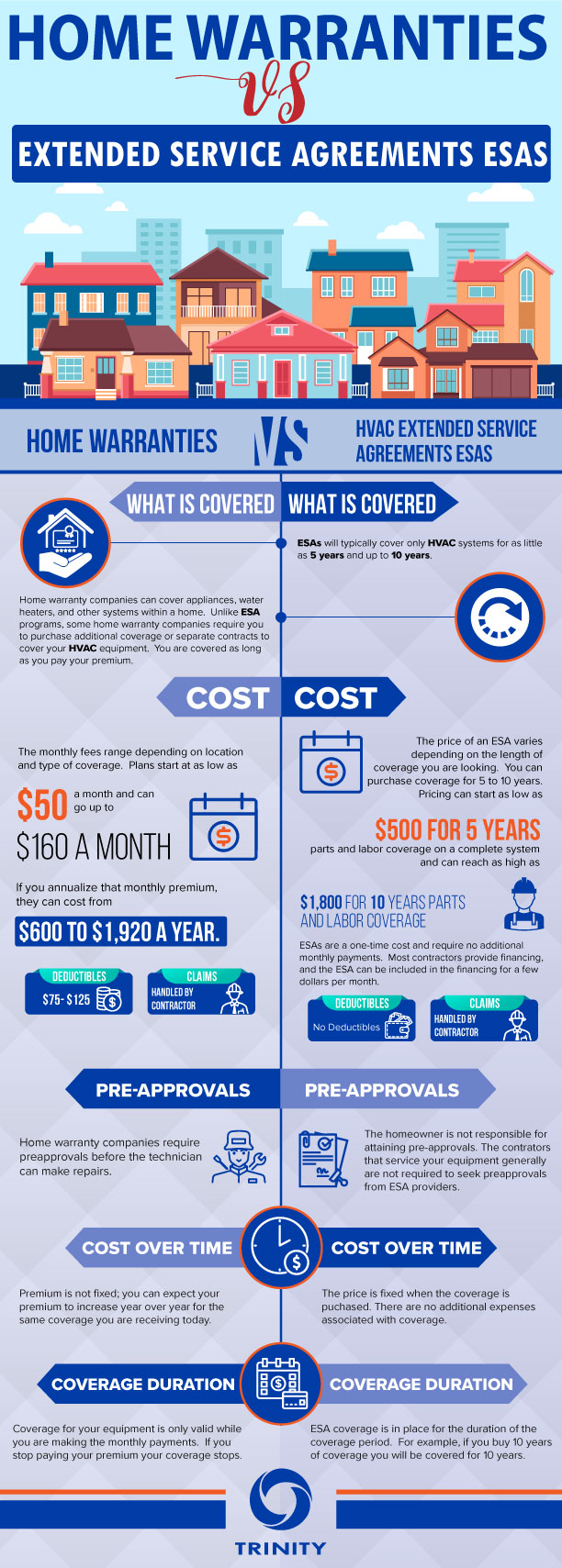

What is the Distinction In Between Residence Service Warranty as well as Residence Insurance Policy A home warranty contract as well as a residence insurance coverage run in comparable means. Both have a yearly costs as well as a deductible, although a home insurance coverage costs as well as insurance deductible is usually a lot greater than a home warranty's. The major distinctions in between house guarantees and house insurance are what they cover.

Some Known Questions About 10 2 10 3.

An additional difference in between a residence warranty as well as home insurance coverage is that house insurance policy is generally required for property owners (if they have a home loan on their home) while a home guarantee strategy is not needed. A residence service warranty as well as residence insurance coverage offer security on various parts of a house, and also with each other they can safeguard a property owner's budget from expensive repair work when they certainly chop up.If there is damage done to the framework of your house, the owner won't need to pay the high costs to repair it if they have house insurance policy. If the damage to the house's framework or homeowner's belongings was caused by a malfunctioning devices or systems, a residence warranty can assist to cover the expensive repairs or replacement if the system or home appliance has actually fallen short from normal deterioration (10 2 10 3).

They will collaborate to provide protection on every part of your house. If you have an interest in acquiring a residence service warranty for your home, take a look at Landmark's house guarantee strategies and also rates below, or demand a quote for your residence below.

10 2 10 3 Can Be Fun For Everyone

In a hot vendor's market where residence customers are waiving the residence assessment backup, purchasing a residence guarantee could be a balm for bother with potential unknowns. To obtain the most out of a home guarantee, it is essential to review the small print so you understand what's covered and exactly how the plan works prior to registering.The distinction is that a house service warranty covers a variety of items instead of simply one. There are three standard sorts of house warranty strategies. System plans cover your residence's mechanical systems, including home heating as well as cooling, electric and pipes. Appliance strategies cover major devices, like the dishwashing machine, stove as well as cleaning maker.

Some products, like in-ground lawn sprinklers, swimming pools and also septic systems, might require an extra service warranty or might not be covered by all residence warranty companies. When comparing residence warranty business, see to it the plan choices incorporate whatever you 'd want covered.New construction residences often come with a warranty from the building contractor.

The Only Guide to 10 2 10 3

Simply put, if you're acquiring a residence and a problem turns up during the residence examination or is kept in mind in the vendor's disclosures, your residence guarantee firm might not cover it. Instead of depending exclusively on a service warranty, try to negotiate with the seller to either treat the issue check my blog or provide you a credit scores to help cover the price of having it dealt with.

The Basic Principles Of 10 2 10 3

For one, home owners insurance policy is called for by loan providers in order to acquire a home loan, while a home warranty is entirely optional. As stated above, a residence service warranty covers the repair and replacement of items and systems in your house.

Just how much does a house warranty cost? Home guarantees generally cost between $300 and also $600 per year; the expense will vary depending upon the kind of strategy you have. The a lot more that's covered, the pricier the plan those attachments can build up. Where you live can additionally impact the price.

What Does 10 2 10 3 Mean?

, you will pay a service cost my website every time a tradesperson comes to your house to review a concern. This cost can range from about $60 to $125 for each service circumstances, making the solution fee one more point to take into consideration if you're shopping for a residence guarantee plan.Report this wiki page